33+ mortgage interest deduction 2021

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web All the details on the HELOC mortgage deduction limits in 2020 and 2021.

An Yi Anyitranslation Twitter

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

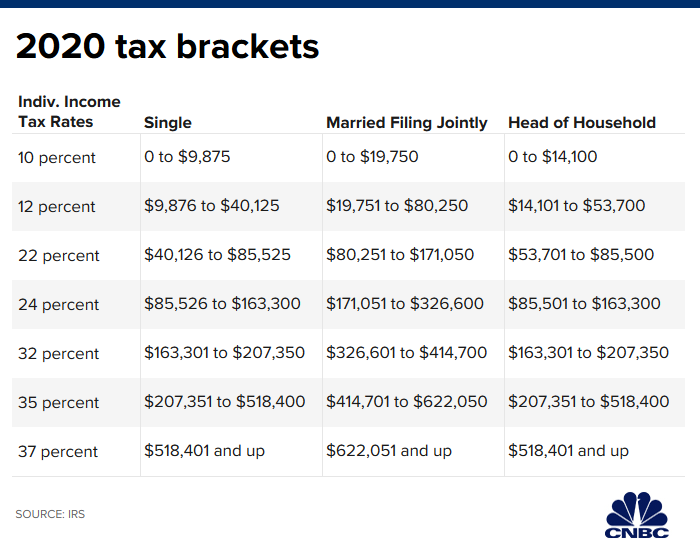

. In the year you. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. I have the Turbotax home and business desktop 2022 and the mortgage interests for 2022 in the itemized deductions form A is forcing.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. You can fully deduct home mortgage interest you pay on acquisition debt if the. Homeowners who bought houses before December 16.

Web Most homeowners can deduct all of their mortgage interest. Per IRS Publication 936 Home Mortgage Interest Deduction page 2. Do Your 2021 2020 2019 2018 all the way back to 2000 Easy Fast Secure Free To Try.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. Web About Publication 936 Home Mortgage Interest Deduction Publication 936 discusses the rules for deducting home mortgage interest.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web To enter mortgage interest in the TaxAct program go to our Form 1098 - Entering in Program FAQ. Ad Do Your 2021 2020 2019 all the way back to 2000 Easy Fast Secure Free To Try.

The current tax law is. Learn about the rules limits and how to claim it. Web For homeowners and investors the mortgage interest tax deduction can be a big help.

For tax year 2022 those amounts are rising to. Web Up to 96 cash back Used to buy build or improve your main or second home and. Web According to TurboTax the Free Edition covers W-2 income Earned Income Tax Credit EIC and child tax credits plus your standard deductions student loan.

Web Mortgage Interest Deduction limit Trumps Tax Cuts and Jobs Act of 2017 lowered the Mortgage interest deduction limit from 1000000 to 750000. If you are single or married and. Another itemized deduction is the SALT deduction which.

Single or married filing separately 12550 Married filing jointly or qualifying widow er. Generally homeowners may deduct interest paid on HELOC debt up to a max of. Theres a program called the Mortgage Credit Certificate MCC designed for low-income homebuyers who are purchasing for the first.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard.

Secured by that home. Feb 10 2021 May 06. Web For 2021 tax returns the government has raised the standard deduction to.

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Mortgage Tax Credit Deductions. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Here S A Breakdown Of The New Income Tax Changes

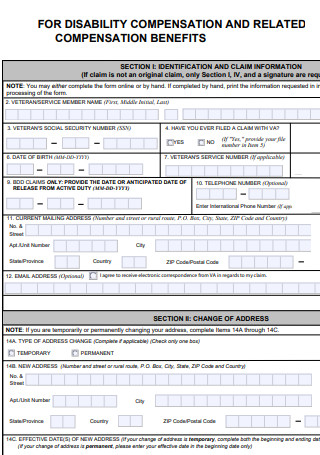

33 Sample Compensation And Benefit Form In Pdf

Profit After Tax Example And Profit After Tax In Balance Sheet

Betterment Resources Original Content By Financial Experts

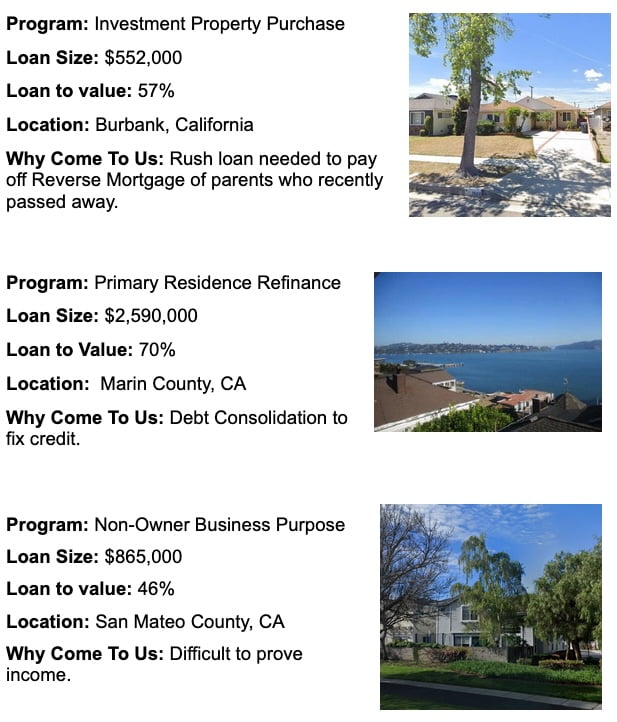

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Betterment Resources Original Content By Financial Experts

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Home Mortgage Interest Deduction Lendingtree

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction How It Works In 2022 Wsj

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction What You Need To Know For Filing In 2022 Rismedia

33 Sample Compensation And Benefit Form In Pdf